Kodiak Cakes Shark Tank Update – Shark Tank Season 5

Cameron Smith and Joel Clark pitch Kodiak Cakes, their whole-wheat pancake and waffle mix brand, to the Sharks, aiming for investment to accelerate their growth.

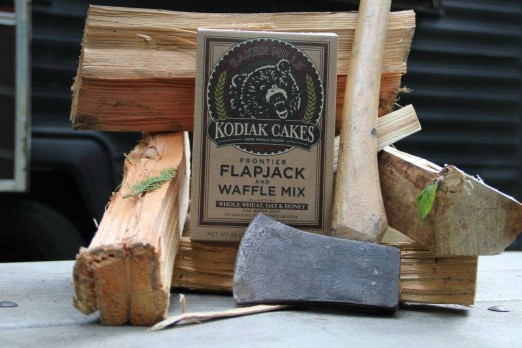

You must have heard many versions of Grandma’s recipe. Cameron Smith and Joel Clark walk onto Shark Tank with their grandfather’s hearty recipe. They bring over Kodiak Cakes, their line of flapjack and waffle mixes, in episode 528. Kodiak Cakes uses Clark’s family recipe for hearty, whole-wheat “hot cakes.

The business started in 1982 when Joel’s mom put the dry ingredients in paper bags for sale. Joel, then eight years old, toted them around the neighborhood and sold every bag! Fast forward 12 years to 1994, and Kodiak Cakes became a real business.

They’re likely looking to the Sharks for retail distribution introductions and cash for expansion.

About Kodiak Cakes

| Category | Details |

| Founder (Plural if multiple) | Cameron Smith and Joel Clark |

| Product Type | Whole-wheat pancake and waffle mixes |

| Funding (Pre-Shark Tank) | Self-Funded |

| Investment Asked | $500,000 |

| Equity Offered | 10% |

Video

What Happened on the Shark Tank Episode?

Cameron and Joel come to the Shark Tank in Season 5 for their business, Kodiak Cakes. The entrepreneurs behind the business present the Sharks with samples of Kodiak Cakes along with their line of fruit-flavored syrups. They are seeking $500,000 in exchange for 10% equity.

They reveal that they have secured placement in Target. Their initial order was for $260,000, and they project sales of over $1 million in Target in the upcoming year. They need a Shark’s investment to grow, move into new markets, and gain additional exposure and marketing expertise.

Mark Cuban asks why they don’t simply borrow against their receivables, an option that wouldn’t require them to give up equity.

The duo plans to “explode” the business, aiming to double their sales in the new year. However, the numbers don’t add up for Kevin O’Leary. He believes that big companies in the market will, if threatened by Kodiak Cakes’ growth, stamp out the competition.

Robert Herjavec asks why they need the money. Joel explains that they need funds for slotting fees—essentially, buying shelf space in retail stores. They plan to grow the business to $20 million in sales within four years and sell it at that time for $30 million.

What Makes Kodiak Cakes Unique?

Kodiak Cakes distinguishes itself with its whole wheat, oat, and honey-based mixes. Notably, their Protein Power Cakes mix has gained widespread popularity as a protein-rich breakfast choice.

The business has a solid distribution. They sell on Amazon and at select Walmart stores. They’re also in Safeway, Albertsons, The Fresh Market, and other major grocery chains. In June, they rolled out their Power Cakes in Target stores nationwide.

- The products are made with one hundred percent whole grains.

- There are no added fats or sugars.

- All you have to do to prepare it is add some water, and it will be ready.

View this post on Instagram

Did Kodiak Cakes Get a Deal on Shark Tank?

After listening to the pitch and understanding the business model, Sharks decide their offers accordingly.

In spite of his needling, Kevin O’Leary makes the pair an offer: $500,000 in return for 50% of the business. Robert Herjavec calls it a “deal with the devil.” O’Leary says he “knows” they aren’t going to take the offer, so he withdraws it and goes out.

- Robert Herjavec puts an offer on the table: he’ll give them $500,000 in exchange for 35%. They thank him but want to hear from Barbara before accepting. She makes a partial offer—$250,000 in return for 20%—but they’ll have to convince a second Shark to invest the additional $250,000.

- Lori Greiner says she “has to love what I get into,” and she doesn’t really like pancakes, so she’s out. Mark Cuban feels the brand is facing major obstacles and drops out.

- Kevin O’Leary is willing to go in with Barbara, but he wants 25% for his $250,000, making the total offer $500,000 for 50%. Robert repeats his offer—$500,000 for 35%.

The pair turns down both offers, feeling the valuations are too low, and walks away without a deal.

What Happened to Kodiak Cakes After Shark Tank?

After an episode airs, we observe the progress of the businesses featured—whether they receive funding or not—and report on their journey.

Although they walked out of Shark Tank without a deal, Cameron and Joel continued to enjoy enormous success with Kodiak Cakes. The brand expanded into even more major retailers and became an “official food” for Weight Watchers, Diabetic Living, and Shape Magazine—important niche markets that further drove sales. While the company may not have reached the $20 million mark the founders estimated, the Shark Tank effect—the boost often enjoyed by entrepreneurs whose products appear on the show—surely skyrocketed their popularity. Even without a Shark deal, this bear of a product kept moving forward.

The business was successful in making $16 million in sales by 2016. By 2020, they had expanded to 26,000 stores and, over time, became a $200 million company. They were then acquired by the private equity group L Catterton for an undisclosed amount in 2021. In November 2022, Valerie Oswalt became the CEO of the company.

Also, do read the Baker Mills Cameron Smith Interview – Kodiak Cakes to learn how Kodiak Cakes grew from a small family business to a national brand, and explore the Whole Grain Flapjacks story—how a simple recipe turned into a household name.

Where Can You Buy It?

Get delicious Kodiak Cakes from their official website and take advantage of exciting offers. You can also find them on Amazon. Check out their social media for more details:

Quick Summary

- The founders, Cameron Smith and Joel Clark, seek $500,000 for 10% equity in Kodiak Cakes.

- They’re already in major retailers like Target and Walmart and aim to expand further.

- Even after having a lot of interest, they walk away without a deal due to valuation disagreements.

- The business has been experiencing significant growth post-show, reaching $200 million in sales and expanding into over 26,000 stores.